AGFP PENSION SCHEME

Trustee Board

From 1 September 2024, the Scheme is governed by a corporate trustee – Capital Cranfield Pension Trustees Limited represented by George Emmerson and Karol Lewandowski. George worked alongside the previous Trustee Board for almost four years prior to the change, and continues his close association with the Scheme as the corporate trustee, providing an important element of continuity.

The Trustee continues to be supported by a number of professional advisors, who also have a wealth of knowledge and experience regarding the operation of the Defined Benefit Section of the Scheme.

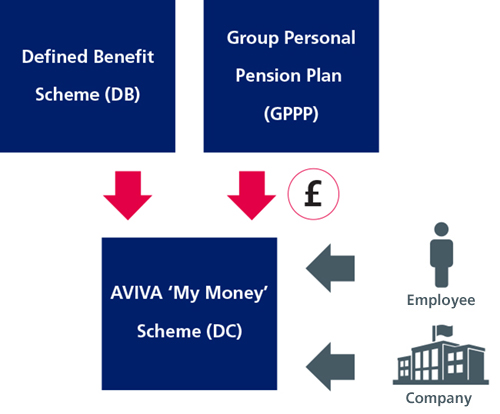

Master Trust Arrangement with Aviva

In July 2024, the Company and the Trustee Board at that time, agreed their intention to move all benefits held in the Defined Contribution Section of the Scheme to a Master Trust arrangement with Aviva. The Company further confirmed the Master Trust would serve as the pension arrangement for its employees and for all new hires in accordance with the Automatic Enrolment Regulations with effect from 1 December 2024.

The Master Trust arrangement simplifies the Company’s pension arrangements for our employees, offers lower member charges, greater benefit flexibility, a range of online tools and education and modernises our retirement offering.

Members now also receive better support as they approach retirement and do not need to transfer their DC benefits to another arrangement if they want to take them flexibility (known as income drawdown).

Our Salary Sacrifice arrangement also continues to operate under the Master Trust arrangement as it did before.

Following a 60 day Consultation period with employees, the Company and the Trustee closed the Defined Contribution Section of the Scheme to existing new entrants and also to future accrual DC with effect from 30 November 2024. A bulk transfer of DC Section benefits held under the Scheme (for all DC members) took place on 27 March 2025 with all benefits within this Section being transferred out of the Scheme to the Aviva Master Trust.

If you haven’t already, we would recommend you register for the online services available via the Master Trust arrangement and you can find information on how to do this via this link https://bcove.video/3np6FZe

Further information regarding the Master Trust arrangement can also be accessed via this link https://workplace.aviva.co.uk/agcchemicals2

The Scheme no longer has a Defined Contribution Section and only Defined Benefit Section remains. Defined Benefits are not impacted by the move to the Master Trust arrangement and continue to be administered by Aptia. If you would like further information regarding your Defined Benefit Section benefits you can contact Aptia via this link Contact Aptia Pensions

Expression of Wish Form(s)

Finally, it’s a good idea to complete an Expression of Wish Form every couple of years reflecting your current circumstances, particularly if you get married or divorced, enter or leave a civil partnership or have a child.

The Expression of Wish lets the Trustee or Trustees know how you would like any resulting benefits to be paid in the event of your death. While this is not binding, it will be taken into account when deciding who to pay benefits to.

A Form for each arrangement can be downloaded via the links below and should be returned once completed:

- Defined Benefit Section – Completed forms to be returned to Louise Coleman – link Expression of wish form DB section.doc.

The Trustee of the Scheme is Capital Cranfield Pension Trustees Limited

2. Aviva Master Trust arrangement – via Aviva’s Master Trust link https://bcove.video/3ANJ3k6. The Trustee of this arrangement is Aviva Master Trust Trustees UK Limited

3. AGC’s Excepted Group Life Assurance arrangement for active employee of the Company – Completed forms can be accessed via UKG under My Info> My HR> HR Actions >Expression of Wish Form. The Trustee of this arrangement is Irwin Mitchell Trustees Limited.